Understanding SPY Yahoo Finance: A Comprehensive Guide

Introduction to SPY

SPY Yahoo Finance, which stands for the SPDR S&P 500 ETF Trust, serves as an exchange-traded fund (ETF) designed to mirror the performance of the S&P 500 index, a benchmark for the U.S. stock market widely regarded as a barometer of the U.S. economy. Launched in 1993, SPY has become one of the most traded financial instruments on the market, and its significance cannot be overstated. It holds a diversified portfolio of the largest publicly traded companies in the United States, encompassing various sectors, which provides investors with an efficient means of accessing the broader market.

Investing in the SPY ETF enables investors to capitalize on the growth of the S&P 500 index without the necessity of purchasing individual stocks. This fund’s structure allows for real-time trading like a stock while combining the stability of a mutual fund. The liquidity and transparency of SPY make it an attractive option for both institutional and individual investors seeking to diversify their portfolios or hedge against market volatility.

Moreover, SPY can be used for various investment strategies, including long-term investing and short-term trading. The ETF’s popularity can be attributed to its low expense ratio, tax efficiency, and ease of access through major brokerage platforms. Investors can closely monitor SPY performance on platforms such as Yahoo Finance, which provides key metrics such as price changes, historical performance, and dividend yields in real time. Thus, for those looking to understand market dynamics or invest strategically, tracking SPY on Yahoo Finance offers critical financial insights. Overall, SPY stands as a fundamental tool in an investor’s arsenal, allowing participants to engage with the S&P 500 efficiently.

Why Use Yahoo Finance for SPY Tracking?

Investing in Exchange Traded Funds (ETFs) like SPY requires access to reliable, real-time data to make informed decisions. Yahoo Finance has established itself as a leading platform for investors, particularly for those monitoring SPY movements. One major advantage of using Yahoo Finance is its user-friendly interface, which allows both novice and seasoned investors to navigate the platform with ease. The intuitive design promotes seamless access to information, making it easier to track SPY performance without unnecessary frustration.

In addition to the straightforward layout, Yahoo Finance provides real-time data crucial for effective SPY tracking. As an index that reflects the performance of the S&P 500, timely updates on SPY prices allow investors to react swiftly to market changes. Yahoo Finance updates this information frequently, ensuring that users have the latest insights into SPY’s performance, which is essential for making purchase or sell decisions effectively.

Moreover, Yahoo Finance offers a plethora of analytical tools that further enrich the tracking experience. Investors can access a range of features, including interactive charts, historical performance data, and news articles linked to SPY. These tools are not only instrumental in understanding market trends but also aid in predicting future movements. The ability to customize alerts, track trends, and analyze data directly correlates with a more insightful investment strategy when it comes to SPY. Investors can also find educational resources to assist them in making sense of patterns and data.

By leveraging the comprehensive tools and resources on Yahoo Finance, investors have the opportunity to effectively monitor and analyze SPY, thus enhancing their investment decisions in a continually fluctuating market environment.

How to Access SPY on Yahoo Finance

Accessing the SPY on Yahoo Finance is a straightforward process that allows investors to monitor the performance of the SPDR S&P 500 ETF Trust. To begin, navigate to the Yahoo Finance website or open the Yahoo Finance app on your mobile device. In the search bar located at the top of the page, type “SPY” and hit enter or click the search icon. This action will direct you to the dedicated page for the SPY ETF, which contains essential information and analytical data.

Once you access the SPY page, you will be greeted with an overview that displays the latest stock price, percentage change, market capitalization, and other relevant metrics. Familiarizing yourself with this interface is crucial, as it provides vital statistics for making informed investment decisions based on SPY performance. Beyond the summary, you can find numerous tabs, including ‘Statistics’, ‘Historical Data’, and ‘Interactive Chart’. Each section offers insights into different aspects of SPY, including its past performance and chart analysis.

For those investing through a mobile device, the steps are similar. Upon opening the app, simply input “SPY” in the search option. Once you access the corresponding page, you will have available the same comprehensive data as the website. Navigating through these sections is essential for obtaining a well-rounded understanding of the SPY ETF and its motions in the market. Charts showing historical performances and real-time updates are prominently displayed, making it easy to track SPY’s performance trends over time.

By effectively using Yahoo Finance’s resources, investors can enhance their knowledge of SPY, enabling better investment strategies.

Key Metrics to Analyze SPY Performance

Monitoring the performance of SPY Yahoo Finance requires a keen understanding of various metrics. One of the primary indicators is price movement, which reflects how the SPDR S&P 500 ETF Trust (SPY) has fluctuated over a specified period. Investors should observe both short-term and long-term trends to assess overall performance. A sustained increase in SPY price can signal positive market momentum, while a consistent decline may warrant caution.

Another critical metric to consider is trading volume. Volume indicates how many shares of SPY are exchanged over a certain timeframe. A spike in volume can suggest heightened investor interest and may accompany significant price movements. Conversely, low volume might suggest a lack of interest or uncertainty about SPY’s future direction. Accessing this data through Yahoo Finance provides real-time insights that are invaluable for making informed investment decisions.

Market capitalization is yet another essential measure, as it reflects the total market value of all shares of SPY outstanding. A large market cap often indicates stability, which can attract risk-averse investors. Additionally, analyzing the expense ratio is crucial. This metric reveals the annual fees that investors must pay to manage the ETF, which can significantly affect overall returns if left unchecked.

Lastly, yield is an important factor for those focused on income generation. The yield calculated from SPY’s dividends offers insights into how much return an investor can expect relative to the price paid for shares. Evaluating these metrics comprehensively can provide a solid framework for analyzing SPY effectively. Armed with this information, investors can make more strategic decisions based on their financial goals and market conditions.

Interpreting SPY Charts on Yahoo Finance

Understanding SPY charts on Yahoo Finance is crucial for investors seeking to make informed decisions regarding their investments. The SPY, or S&P 500 ETF Trust, tracks the performance of the S&P 500 Index, and utilizing charts can provide invaluable insights into market trends and price movements. When accessing SPY charts, users will find various chart types, including line charts, candlestick charts, and bar charts. Each chart type offers a different perspective on price behavior, with candlestick charts being particularly helpful for discerning price action and market sentiment.

Furthermore, selecting the appropriate timeframe is essential to accurate analysis. Yahoo Finance offers multiple timeframes ranging from one minute to five years, allowing investors to tailor their analysis based on their trading strategy. Short-term traders may prefer minute or hourly charts to identify immediate opportunities, while long-term investors may focus on daily or weekly charts to gauge the overall market trend. It is beneficial to switch between timeframes for a more comprehensive understanding of SPY’s performance.

In addition to chart types and timeframes, investors can enhance their analysis by incorporating technical indicators. Yahoo Finance allows users to add various indicators such as Moving Averages, Relative Strength Index (RSI), and Bollinger Bands to their SPY charts. These indicators can assist in identifying potential entry and exit points, as well as assessing momentum and market volatility. Utilizing a combination of different chart types and indicators will provide a robust framework for making informed investment decisions on SPY.

In conclusion, mastering the interpretation of SPY charts on Yahoo Finance involves understanding different chart types, selecting appropriate timeframes, and leveraging technical indicators to aid in decision-making. This skillset is essential for improving the effectiveness of SPY investments.

Recent Trends and News Affecting SPY

The SPDR S&P 500 ETF Trust, commonly referred to as SPY, has recently been influenced by several notable trends and news events that merit consideration for investors. As a significant instrument on Yahoo Finance, SPY is designed to reflect the performance of the S&P 500 Index, making it sensitive to a variety of economic and geopolitical factors.

Recent geopolitical developments have played an essential role in shaping market sentiment and, consequently, SPY’s performance. Tensions regarding international trade, notably between the United States and other economies, can sway investor confidence, resulting in fluctuations in SPY prices. Events such as trade agreements or geopolitical conflicts have the potential to prompt significant movements within the equity markets, which are closely monitored on platforms like Yahoo Finance.

Moreover, macroeconomic indicators released by trusted sources also have a substantial impact on SPY. For instance, employment rates, inflation data, and GDP growth figures can lead investors to reevaluate their positions. Positive economic releases often contribute to a bullish sentiment in markets, while disappointing data may lead to a bearish outlook that directly correlates to SPY’s value. Staying abreast of these metrics can aid investors in making informed decisions regarding their holdings in SPY.

Finally, market sentiment—shaped by investor psychology and prevailing news narratives—can lead to irrational market behavior that affects SPY prices as well. Analysts and traders often utilize feedback from news coverage available on platforms such as Yahoo Finance to gauge public sentiment and the possible trajectory of SPY. Hence, understanding these trends and remaining vigilant about news developments can empower investors to navigate the complexities of the ETF landscape effectively.

Comparing SPY with Other ETFs

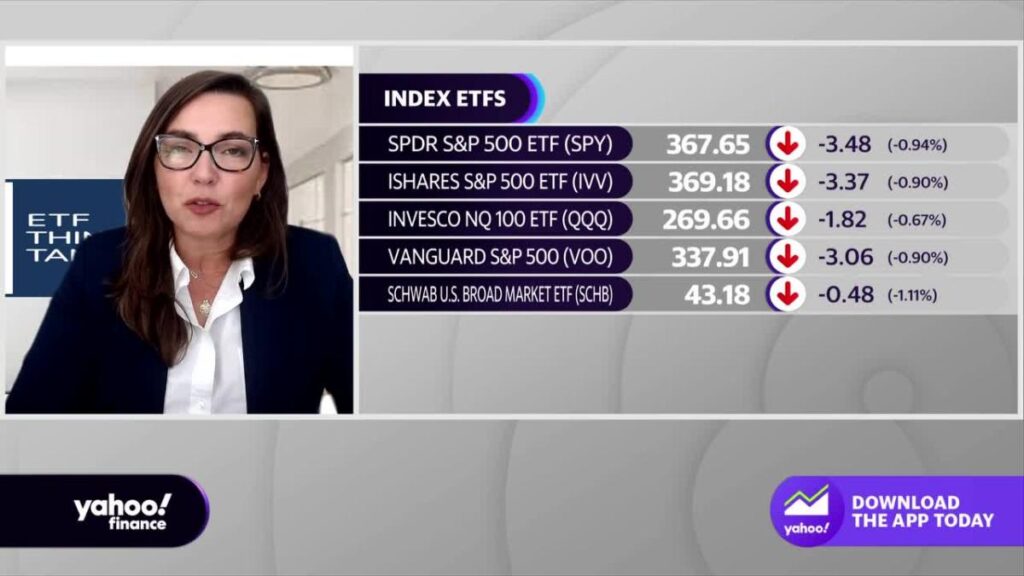

When evaluating investment options in the exchange-traded fund (ETF) landscape, SPY is often compared with other prominent ETFs, specifically IVV (iShares Core S&P 500 ETF) and VOO (Vanguard S&P 500 ETF). All three funds aim to replicate the performance of the S&P 500 Index, making them popular choices among investors. However, there are notable similarities and differences that can influence investment decisions.

SPY, managed by State Street Global Advisors, was the first ETF listed in the United States and continues to be one of the most heavily traded funds. It has an expense ratio of 0.09%, which is quite competitive. IVV, managed by BlackRock, also seeks to track the S&P 500 and offers a remarkably low expense ratio of 0.03%, making it an attractive option for cost-conscious investors. VOO, managed by Vanguard, has a similar expense ratio of 0.03%, providing investors with another low-cost alternative.

When it comes to liquidity, SPY stands out due to its significant trading volume, making it highly liquid. This feature allows investors to enter and exit positions with ease, but increased liquidity may come with tighter bid-ask spreads. IVV and VOO, while still liquid, do not match the trading volume of SPY, meaning that investors may face wider spreads when trading these ETFs.

Moreover, all three ETFs distribute dividends based on their underlying holdings, tracking the index effectively. However, since SPY is structured as a unit investment trust, it distributes dividends on a different schedule compared to IVV and VOO, which operate as open-ended funds. This could be a consideration for income-focused investors.

In conclusion, while SPY, IVV, and VOO serve similar purposes in providing exposure to the S&P 500 Index, their differences in expense ratios, liquidity, and dividend distribution schedules create unique considerations. Investors should weigh these factors carefully to determine which ETF best aligns with their investment strategy and goals.

Long-Term Investment Strategies with SPY

Investing in the SPDR S&P 500 ETF Trust, commonly referred to as SPY, can serve as a foundation for various long-term investment strategies. One prominent approach is dollar-cost averaging (DCA), which involves investing a fixed amount of money into SPY at regular intervals, regardless of market conditions. This strategy allows investors to accumulate shares over time, reducing the impact of market volatility and potentially lowering the average cost per share. For instance, during periods of market downturns, purchasing SPY can provide a unique opportunity to acquire more shares at lower prices, which can be particularly advantageous for long-term investors.

Another effective long-term strategy is the buy-and-hold approach. This involves purchasing SPY and holding onto it for an extended period, typically several years or even decades. Historically, the S&P 500 has demonstrated an upward trajectory over the long term, and this strategy allows investors to benefit from compounding returns. By maintaining ownership of SPY during market fluctuations, investors can avoid the risks associated with trying to time the market, which often leads to missed opportunities for growth.

Additionally, reinvesting dividends is a powerful tactic for building wealth over time using SPY. The ETF pays dividends, which can be automatically reinvested to purchase additional shares of SPY. This not only increases the investor’s stake in the fund but also harnesses the power of compounding returns. Over time, the reinvestment of dividends can significantly enhance total returns, making it an integral component of a long-term investment strategy.

In conclusion, employing strategies such as dollar-cost averaging, buy-and-hold, and reinvesting dividends when investing in SPY can provide a robust pathway for wealth accumulation. These approaches enable investors to navigate market fluctuations while capitalizing on the long-term growth potential of the S&P 500 index.

Conclusion

In the realm of investment tracking, utilizing platforms like Yahoo Finance to monitor SPY—the popular exchange-traded fund that mirrors the S&P 500 index—holds significant importance. Throughout this guide, we have delved into the multifaceted aspects of accessing and analyzing SPY on Yahoo Finance. The platform’s user-friendly interface and comprehensive data make it an optimal choice for both novice and experienced investors alike.

Investors frequently seek real-time data, historical performance metrics, and market news, all of which are easily accessible via Yahoo Finance. This accessibility is particularly valuable when tracking SPY, as it allows investors to make informed decisions based on up-to-date information regarding market trends and economic developments. Moreover, Yahoo Finance offers insightful tools such as interactive charts and analytical reports, which can further enhance the investment experience.

Through effective tracking of SPY on Yahoo Finance, investors can better understand market dynamics and develop strategies tailored to their individual financial goals. As the landscape of investment continues to evolve, the ability to access reliable financial data becomes paramount. By leveraging Yahoo Finance, investors can efficiently navigate the complexities of the stock market and enhance their portfolios with strategic placements in SPY.

In conclusion, adopting Yahoo Finance as a resource for tracking SPY empowers investors to stay ahead of the curve. By consistently monitoring this crucial financial instrument, investors can optimize their investment decisions and better prepare themselves for market fluctuations, ultimately leading to more successful investment outcomes.

You May Also Read This Bettermentbusiness.