Exploring GME StockTwits: The Social Media Phenomenon Behind GameStop’s Stock Surge

Introduction to GME StockTwits

GME StockTwits is a social media platform designed specifically for traders and investors, allowing them to share real-time information, insights, and opinions regarding various stocks. Launched in 2009, this platform has grown exponentially, becoming a crucial tool for those participating in the stock market. Unlike traditional social media channels, which cater to diverse interests, StockTwits focuses solely on financial discussions, thereby attracting a user base that is passionate about investing and trading.

One of the platform’s distinctive features is its ability to facilitate community-driven content. Users can post messages, which are often referred to as “tweets,” that include a variety of tags for different stocks. This tagging system is particularly beneficial for tracking sentiments related to specific stocks, such as GME, or GameStop Corp. As the company became the center of attention due to unprecedented trading activity in early 2021, StockTwits emerged as a crucial source of information and community engagement, allowing investors to coordinate and share their thoughts on GameStop’s volatile market performance.

The relevance of StockTwits in the context of GME is undeniable. As traders flocked to the platform, the discussions surrounding GameStop’s stock price soared, leading to significant price movements influenced by social sentiment rather than traditional market fundamentals. The Gomé stocktwits community played a pivotal role in shaping perceptions and decisions around GME, leveraging the platform’s engageability to influence outcomes in the stock market actively.

This integration of social media into trading dynamics underscores the growing importance of platforms like StockTwits in today’s financial landscape, where information and sentiment can shift market directions almost instantaneously. Through this unique interface, both novice and experienced traders can navigate the complexities of investing, particularly exemplified by the case of GME and its notable community-driven momentum in the financial market.

The Background of GameStop and Its Stock Performance

GameStop Corp., established in 1984, is an American retail company that specializes in video games, consumer electronics, and gaming merchandise. Primarily known for its physical retail stores, GameStop’s business model evolved around the sale of both new and pre-owned gaming products. However, as digital distribution gained prominence, GameStop’s brick-and-mortar strategy began to show signs of vulnerability, leading to a decline in market performance over the years. The company faced increasing competition from online platforms and changing consumer preferences, which adversely affected its financial health.

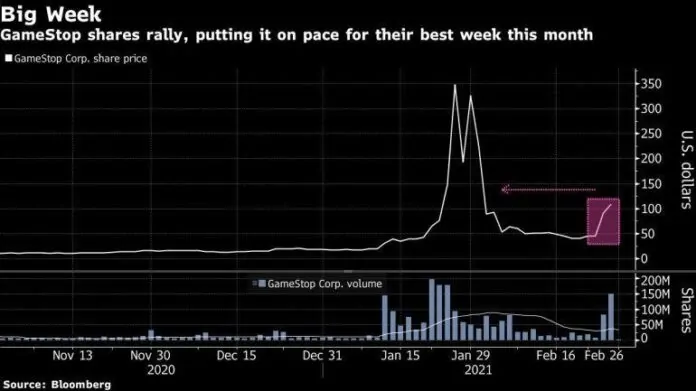

Prior to the dramatic trading events of early 2021, GameStop had experienced considerable stock price fluctuations, often characterized by significant bearish sentiment from institutional investors. A notable factor in this narrative was the prevalence of short selling, wherein investors bet against the company’s performance by borrowing shares to sell at a lower price. This strategy resulted in GameStop becoming one of the most shorted stocks on the market, raising eyebrows among retail investors who perceived an opportunity for a short squeeze.

The backdrop of this trading phenomenon is critical to understanding why GME StockTwits gained traction. As retail investors began collaborating on StockTwits and other social media platforms, discussions around GME stock surged, ultimately driving an unprecedented increase in its share price. Key moments, such as news articles highlighting the company’s financial struggles and the emergence of retail trading communities, contributed to a perfect storm of interest and investment. The transformational impact of these online discussions illustrated not only a significant shift in stock trading dynamics but also positioned GameStop as a case study in the changing landscape of retail investing.

How StockTwits Became Central to the GME Trading Community

StockTwits has evolved into a pivotal platform for discussing GME stock, especially amid the heightened volatility and dramatic events surrounding GameStop’s stock trading. Initially designed as a social media platform for investors, StockTwits gained significant traction in early 2021 as retail traders, often referred to as “apes,” turned to this forum for real-time news and analysis. The platform’s unique integration of social networking and market data enabled users to share insights, strategies, and opinions about GME, facilitating a more collaborative trading environment.

One of the most notable occurrences that solidified StockTwits’ significance was the infamous short squeeze in January 2021. As the stock price of GameStop soared, retail investors rallied together on StockTwits, using the platform to coordinate buying efforts and encourage others to hold the stock. This sense of community transformed individual trading activities into a collective movement, underscoring the power of social media in shaping market dynamics. Consequently, StockTwits became a repository of real-time information where users discussed momentum shifts, technical analysis, and rumors regarding GME’s stock performance.

The instantaneous nature of StockTwits allows for immediate feedback and an exchange of ideas, making it an invaluable resource for traders navigating the rapid fluctuations of GME stock. Users often post charts, sentiment analysis, and personal insights, making the platform a unique blend of traditional market research and social engagement. The hashtag system further categorizes discussions, allowing users to easily follow real-time updates related to GME or broader market trends. As stock market events unfold, the intensity of conversations on StockTwits offers a glimpse into the collective psyche of retail investors, amplifying their influence on GME’s trajectory and, by extension, the broader market landscape.

Key Trends and Insights from GME StockTwits Conversations

The GME StockTwits platform has become a pivotal social media venue where investors congregate to discuss all matters related to GameStop’s stock performance. Analysis of conversations within this digital space reveals various emerging trends, topics, and sentiments that provide valuable insights into investor behavior and market dynamics.

One prominent trend identified across GME StockTwits discussions is the frequent use of specific hashtags such as #GME, #GameStop, and #WallStreetBets. These hashtags not only serve to categorize conversations but also amplify visibility, attracting a wider audience to discussions. Moreover, sentiment analysis indicates a noticeable oscillation between bullish and bearish sentiments, often in reaction to external news and market events. Traders engage in spirited debates regarding potential price movements, reflecting a community that thrives on speculation and shared insights.

Topics related to short selling strategies and options trading frequently dominate the discussions. Investors on GME StockTwits often share data regarding short interest, leading to an informed collective sentiment about potential gamma squeezes. This level of engagement suggests that conversations on StockTwits can directly influence trader psychology and, by extension, stock price movements. For instance, when positive news regarding GameStop emerges, sentiment shifts toward bullish conversations, with many traders encouraging purchases, which can subsequently lead to a surge in stock prices.

In closing, the vibrant discourse surrounding GME on StockTwits offers a microcosm of the broader trends in retail investing. By analyzing key conversations, hashtags, and prevailing sentiments, one can glean how this social media phenomenon shapes investor strategies and impacts market behavior. Consequently, GME StockTwits is not merely a platform for discussion but a dynamic element in the stock’s trading narrative that merits consideration by both novice and seasoned investors alike.

The Role of Influencers and Community Sentiment

In the realm of online trading discussions, platforms like StockTwits have become crucial in shaping market sentiment, particularly regarding stocks such as GME. This social media phenomenon has demonstrated that influential users and market analysts carry substantial weight in the conversations surrounding specific stocks. Their insights and comments can significantly sway the opinions of average traders who rely on these discussions for decision-making.

Influencers on StockTwits, often characterized by a robust following, have the ability to shift community sentiment rapidly. When a respected voice speaks positively about GME stock, it can lead to a herd mentality where investors rush to buy, driven by the optimistic predictions shared within the community. Conversely, negative commentary can lead to panic selling, showcasing the profound impact that these influencers wield. Their penchant for sharing analyses, predictions, and sentiments creates an environment where trust and credibility are paramount. Traders often look to these figures for guidance, thereby amplifying their influence within the community.

The dynamics of social trading hinge on collective sentiment, where the perceptions and emotions of a group can drive market movements just as much as technical indicators or fundamental analyses. In discussions about GME stock on platforms like StockTwits, this dynamic plays out in real time. The interplay of opinions can motivate traders to jump on board particular trends or to exit positions based on the prevailing sentiment. As a result, community sentiment, fueled by influential users, becomes a critical indicator of market activity, especially for volatile stocks like GME.

This synergy between influencers and community sentiment underscores the importance of discernment in these online forums. As novice traders engage with the chatter on StockTwits, understanding the source and context of opinions shared is vital to making informed investment decisions in the ever-evolving stock landscape.

The Risks and Challenges of Trading GME on StockTwits

The recent phenomenon surrounding GameStop (GME) and its stock price surge has captured considerable attention on platforms such as StockTwits. While this social media outlet provides an innovative way for traders to share insights and strategies, it also brings forth certain risks and challenges that potential investors must navigate. Understanding these risks is essential for anyone considering trading GME based on discussions from StockTwits.

One significant risk associated with GME trading on StockTwits is the inherent market volatility. Given the highly speculative nature of the stock, price fluctuations can occur within short time frames, leading to potential losses for uninformed investors. Reliance on real-time updates from StockTwits can lead to emotional decision-making rather than analytical reasoning, as rapid price movements and trending sentiments on the platform can create impulsive reactions.

Another critical challenge is the prevalence of misinformation. In the fast-paced environment of social media, rumors and misleading claims can quickly gain traction. Traders relying solely on information from StockTwits may encounter exaggerated or inaccurate analyses that could misguide their investment approaches. Therefore, it is advisable for GME stockholders to corroborate insights gathered from StockTwits with independent research before acting on any recommendations.

Herd behavior is also a pivotal factor to consider when trading GME on StockTwits. The platform can amplify collective behaviors, where decisions made by a few influential voices can lead to cascading effects across the broader trading community. This herd mentality may prompt traders to follow the crowd, which can be detrimental when sentiment shifts suddenly and unpredictably, highlighting the importance of individual assessment over collective trends.

In conclusion, while StockTwits offers valuable insights for GME traders, it is critical to remain aware of the associated risks, including market volatility, misinformation, and herd behavior. Engaging in thorough research and maintaining an analytical mindset can significantly enhance the trading experience and minimize the potential for financial loss.

Success Stories: How StockTwits Users Capitalized on GME’s Surge

The rise of GameStop’s stock, frequently discussed in the context of gme stocktwits, has led to numerous success stories among retail investors. Many users on the StockTwits platform leveraged community insights to make informed trading decisions that resulted in significant financial gains. One particular case involves a user known for comprehensive market analysis who shared real-time insights into GME’s volatility. By monitoring trends and patterns on gme stocktwits, this individual positioned themselves at the right moment, buying stock before the price surge. The timing of their trade was crucial; they sold a portion of their shares at a peak price, securing profit and subsequently reinvesting a portion of those earnings into other stocks recommended within the community.

Another notable anecdote involves a group of friends who relied on gme stocktwits to make collective trading decisions. By sharing analytical tools and techniques observed in the feeds, they developed a strategy focused on both short-term and long-term investing. This group’s ability to synthesize information from various StockTwits posts enabled them to identify signals for entering and exiting trades, leading to impressive returns. The emotional support provided by the community also played a significant role, as they encouraged one another to hold their shares during times of market fluctuation, which ultimately paid off during a subsequent rally.

Furthermore, the stories of users who utilized sentiment analysis techniques have emerged prominently within gme stocktwits discussions. By assessing the overall mood and sentiment reflected in posts, these investors successfully anticipated market movements. Their ability to gauge bullish or bearish sentiment offered them a competitive edge, allowing them to enter the market with confidence. These success stories illustrate the impactful synergy between community engagement and analytical approaches, demonstrating how individuals can effectively harness StockTwits to improve their trading strategies and outcomes amidst the frenetic trading environment surrounding GME.

Future Outlook: GME and StockTwits in a Post-Pandemic World

The trading landscape has shifted dramatically as a result of the pandemic, with retail investors becoming an increasingly powerful force in the stock market. The phenomenon surrounding GameStop, or GME, exemplifies how platforms like StockTwits have transformed stock trading, allowing individual investors to collaborate, share insights, and ultimately impact stock prices. As we look to the future, it is essential to understand the potential market trends that may shape the retail investor’s role and the influence of StockTwits.

In a post-pandemic environment, it is likely that the enthusiasm generated by events such as the GME stock surge will continue to attract new traders to the market. The rise of social media-based investing has facilitated a democratization of financial knowledge, where individuals can access valuable information and perspectives previously reserved for institutional investors. In this new landscape, platforms like StockTwits will remain pivotal in shaping investor behavior and decision-making, fostering a community where insights and strategies can be shared rapidly.

Furthermore, GME’s volatility has highlighted the importance of sentiment analysis in stock trading. The role of social media as an information hub may evolve, with tools designed to analyze trends and sentiment—making it easier for retail investors to gauge market emotions. This trend indicates a future where analytical tools integrated with platforms like StockTwits can further enhance the decision-making processes for everyday investors.

As we approach a new era in trading, the continued engagement of retail investors through platforms like StockTwits will likely redefine investment strategies. Rather than relying solely on traditional analysis methods, future investors may leverage community insights to drive their trading decisions. It is clear that the GME phenomenon will leave a lasting impact on the financial landscape, making platforms like StockTwits indispensable in navigating the complexities of modern-day trading.

Conclusion: The Legacy of GME and StockTwits

The impact of GME and its discussions on StockTwits represent a transformative moment in the stock market and trading culture. GME’s unprecedented stock surge in January 2021 can largely be attributed to the fervent activity and communication among retail investors on platforms like StockTwits, demonstrating the collective power of social media in contemporary investing. Investors were able to share insights, rally support, and strategize, fundamentally altering the typical dynamics of stock trading.

This phenomenon not only prompted a reevaluation of the traditional roles of institutional investors and hedge funds, but also highlighted the growing influence of online communities on stock market performance. The discussions on StockTwits were not merely isolated conversations; they formed a movement that underscored the desire for democratized investment opportunities. Such engagement has left a lasting legacy, prompting regulators and established market players to adapt to a new landscape shaped by social media interactions.

Moreover, this episode has instilled valuable lessons in risk management, investor psychology, and the sheer impact of collective action. The GME situation has encouraged a more informed and cautious approach to trading, where mental frameworks around volatility and speculation are critically reconsidered. Although the fervor surrounding GME may eventually fade, the lessons learned remain relevant. Investors and analysts alike would benefit from recognizing the potency of social platforms, such as StockTwits, in influencing market trends and investor sentiment.

In light of these developments, the GME stock and StockTwits will likely continue to evoke thoughtful discussions surrounding investment strategies and the future trajectory of retail trading culture. As social media’s role in finance evolves, so too will the methodologies and practices of investors striving to navigate this dynamic environment.

You May Also Read This Bettermentbusiness.